Few topics are more fraught in NYC than rent regulation and stances about it are typically set by where people are financially and ideologically. It is always useful when someone tries to add some good old-fashioned facts to the debate in order to help craft good policies. That is particularly true now, given that NYC’s rent laws are supposed to expire on June 15th.

The Citizens Budget Commission has issued a report, 5 Myths About Rent Regulation in New York City. The CBC is hoping that that this report will inform the New York State legislature’s debates over the renewal of New York City’s rent laws (for those who don’t follow this carefully, NYS has jurisdiction over NYC’s rent regulation). Unfortunately, the report is ideologically skewed, which limits its usefulness for those trying to get their hands around this topic.

Here are the CBC’s five “Myths” and “Facts:”

Myth 1: A majority of tenant households in New York City are rent burdened.

Fact 1: 38 percent of tenant households in New York City are rent burdened.

Myth 2: Market-rate units in New York City are not affordable to most tenants.

Fact 2: In market-rate units, 54 percent of tenants have affordable rent.

Myth 3: A rent-regulated housing unit is an affordable unit.

Fact 3: Among tenants in rent-regulated units, 44 percent are rent-burdened.

Myth 4: Middle-income households cannot find affordable housing in New York City.

Fact 4: Outside of Manhattan, 96 percent of middle-income tenant households are not rent burdened.

Myth 5: The number of rent-regulated units is rapidly declining.

Fact 5: The number of rent-regulations is stabilizing.

The CBC claims that public officials and housing advocates are using “problematic” figures and characterizations. That is most certainly true in many cases, and par for the course for advocates. But the CBC does much the same, which should not be par for the course for a nonpartisan civic organization.

The second “Fact” is particularly laughable because CBC is doing exactly what it accuses advocates of doing — some form of rhetorical bait and switch. The second “Myth” is about tenants overall, while the second “Fact” is just about tenants who are currently in market-rate apartments. This is an apples to oranges comparison. Once you see the bait and switch, you see that CBC’s figures actually support the truth of this supposed second “Myth.” There are more problems contained in this document, but I leave it to you to find them for yourself.

I have no problem with CBC trying to make the debate over rent regulation more fact-based. But CBC should follow the wise advice of Polonius: “This above all: to thine own self be true.”

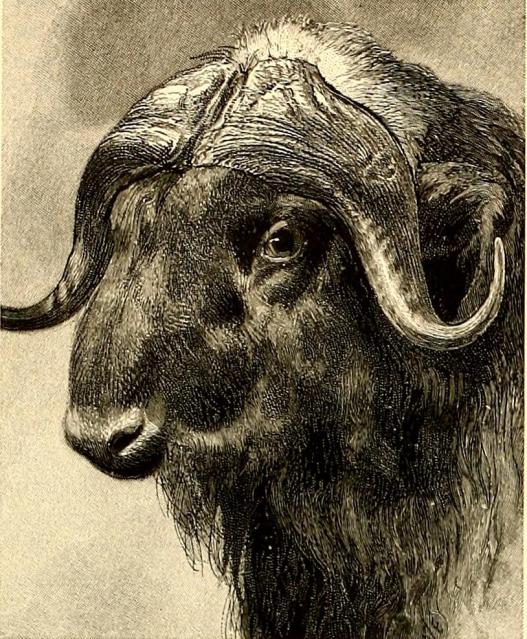

Picture: "Polonius" by https://www.oregonlink.com/elsinore/poveyglass/polonius.html.